Once again the world is conspiring to humiliate the Insider. No sooner had I opined that the shooting industry is lacking in market share data than two surveys surfaced, one dedicated to “modern sporting rifles” (MSR) and another to the overall industry.

The MSR survey was conducted for the National Shooting Sports Foundation (NSSF) while the overall study was done for subscribers to a market research company called Southwick & Associates. Both are entirely Internet-based, which limits their scope to Internet savvy shooters and hunters who participate in forums, chat rooms and are willing to give their opinions online, a group I’ll maintain is only marginally representative of the overall shooting market.

The MSR survey was based on approximately 11,000 respondents and the Southwick study on roughly 40,000. There are approximately 2 million firearms and about 15 million hunting licenses sold annually. That said, both studies are considered statistically valid. (As a means of comparison, a mere 24,000 households are equipped with Nielson monitors and yet billions of television advertising dollars are based on the viewing habits of this minuscule number.)

Without further ado, let’s look at the raw data from the Southwick survey:

• Top rifle brand: Remington (17.5 percentof all purchases)

• Top shotgun brand: Remington and Mossberg (virtual tie with 21.5 percentof all purchases)

• Top muzzleloader brand: Thompson Center (31.9 percentof all purchases)

• Top handgun brand: Ruger (16.7 percentof all purchases)

• Top scope for firearms: Bushnell (17.1 percentof all purchases)

• Top rifle ammunition brand: Remington (25.3 percentof all purchases)

• Top shotgun ammunition brand: Winchester (31.9 percentof all purchases)

• Top handgun ammunition brand: Winchester (22.0 percentof all purchases)

• Top blackpowder brand: Pyrodex (38.7 percentof all purchases)

• Top balls, bullets, or shot brand: Hornady (28.4 percentof all purchases)

• Top bow brand: Matthews (17.5 of all purchases)

• Top arrow brand: Carbon Express percent(27.6 percentof all purchases)

• Top fletching brand: Blazer (15.8 percentof all purchases)

• Top broadhead brand: Muzzy (20.3 percentof all purchases)

• Top archery target brand: The Block (10.3 percentof all purchases)

• Top decoy brand: Mojo (12.9 percentof all purchases)

• Top game call brand: Primos (33.5 percentof all purchases)

• Top reloading bullet brand: Hornady (31.7 percentof all purchases)

• Top reloading primer brand: CCI (38.2 percentof all purchases)

• Top reloading powder brand: Hodgdon (37.8 percentof all purchases)

• Top binocular brand: Bushnell (33.6 percentof all purchases)

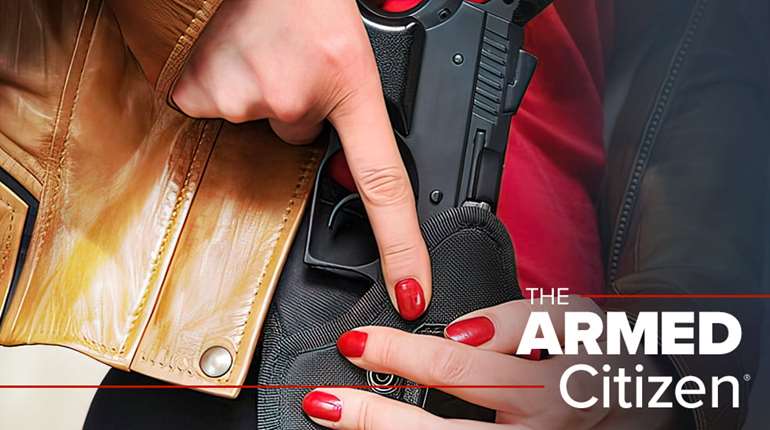

• Top holster brand: Uncle Mikes (19.0 percentof all purchases)

• Top knife brand: Gerber (15.0 percentof all purchases)

• Top scent or scent covering brand: Scent-A-Way, Scent Shield (14.7 percentof all purchases each)

• Top shooting target brand: Shoot-N-C (31.3 percentof all purchases)

• Top clay brand: White Flyer (51.8 percentof all purchases)

Notice that the survey doesn’t reference dollars, only the number of units purchased. Bushnell, for example, holds the largest share of both scopes and binoculars, but it’s a value brand and you always sell more units at $300 than you do at $600. From a pure dollar standpoint, Leupold has long been recognized as the market leader in U.S. optics with Nikon second.

Looking at firearms, again you see value brands at the top. Ruger, Mossberg and Remington guns are all affordably priced. Winchester has only now began production after a two year hiatus, so that would also affect the result.

Similarly, Uncle Mike’s is the Walmart of holsters, offering decent quality at unbeatable prices. No wonder they dominate in number of units sold, but I would bet dollars to donuts that Safariland’s price points are far higher.